And because some SDIRAs which include self-directed regular IRAs are subject to expected minimum amount distributions (RMDs), you’ll must system in advance making sure that you have sufficient liquidity to meet The principles set because of the IRS.

No matter whether you’re a economical advisor, investment issuer, or other financial Expert, investigate how SDIRAs may become a strong asset to increase your small business and reach your Experienced goals.

Property is one of the most well-liked options amid SDIRA holders. That’s for the reason that you are able to put money into any kind of real estate property which has a self-directed IRA.

Larger investment alternatives suggests you are able to diversify your portfolio past shares, bonds, and mutual resources and hedge your portfolio versus market fluctuations and volatility.

At times, the costs connected to SDIRAs might be greater and much more difficult than with a regular IRA. This is because with the elevated complexity connected to administering the account.

Minimal Liquidity: A lot of the alternative assets that can be held in an SDIRA, like property, private fairness, or precious metals, is probably not easily liquidated. This may be a concern if you'll want to accessibility money speedily.

Criminals in some cases prey on SDIRA holders; encouraging them to open up accounts for the goal of earning fraudulent investments. They often idiot buyers by telling them that When the investment is accepted by a self-directed IRA custodian, it have to be respectable, which isn’t true. All over again, Be sure to do thorough homework on all investments you decide on.

Feel your Buddy may be starting the subsequent Fb more info here or Uber? With an SDIRA, you can invest in leads to that you suspect in; and likely get pleasure from bigger returns.

The tax pros are what make SDIRAs appealing For most. An SDIRA is usually both traditional or Roth - the account kind you select will depend mainly on the investment and tax system. Test with all your economical advisor or tax advisor for those who’re Uncertain which can be ideal to suit your needs.

Shifting funds from a single variety of account to another form of account, which include shifting cash from the 401(k) to a standard IRA.

Simplicity of use and Technological innovation: A person-welcoming platform with online equipment to track your investments, post files, and control your account is important.

Set only, should you’re trying to find a tax effective way to build a portfolio that’s more personalized to the interests and skills, an SDIRA could be the answer.

Therefore, they have an inclination not to market self-directed IRAs, which supply the flexibility to invest in a very broader number of assets.

Lots of buyers are stunned to master that working with retirement funds to take a position in alternative assets has been doable because 1974. On the other hand, most brokerage firms and banks target featuring publicly traded securities, like stocks and bonds, given that they deficiency the infrastructure and know-how to manage privately held assets, like real-estate or personal fairness.

Opening an SDIRA can give you entry to investments Typically unavailable by way of a lender or brokerage firm. Below’s how to begin:

IRAs held at banking companies and brokerage firms provide limited investment alternatives for their customers given that they would not have the experience or infrastructure to administer alternative assets.

While there are numerous Added benefits affiliated with an SDIRA, it’s not with out its personal disadvantages. Several of the widespread explanation why traders don’t pick SDIRAs contain:

SDIRAs are frequently utilized by fingers-on traders who're ready to take on the hazards and obligations of selecting and vetting their investments. Self directed IRA accounts can be great for investors who've specialized understanding in a distinct segment market which they would want to put money into.

Range of Investment Solutions: Ensure the service provider will allow the categories of alternative investments you’re thinking about, which include real-estate, precious metals, or non-public equity.

Judd Nelson Then & Now!

Judd Nelson Then & Now! Loni Anderson Then & Now!

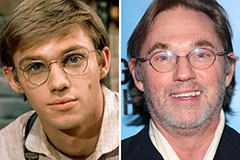

Loni Anderson Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!